where does your credit score start canada

Before you apply for credit and start accumulating points your FICO score does not exist. Once youve opened a line of credit typically your first credit card your credit score will begin to.

What Is The Fastest Way To Raise Your Credit Score To Buy A House National Crowdfunding Fintech Association Of Canada

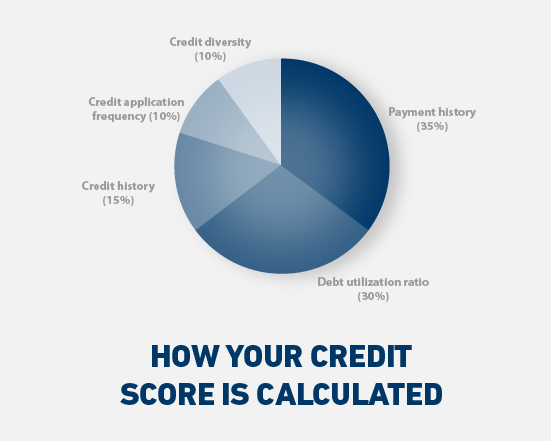

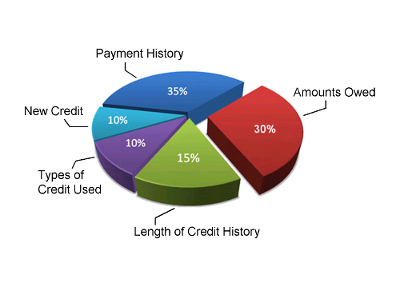

Several key factors make up your credit score.

. To do this you have to. This is because a lender may give more weight to certain information when calculating your credit score. Take advantage of this loan product for only 1999 per.

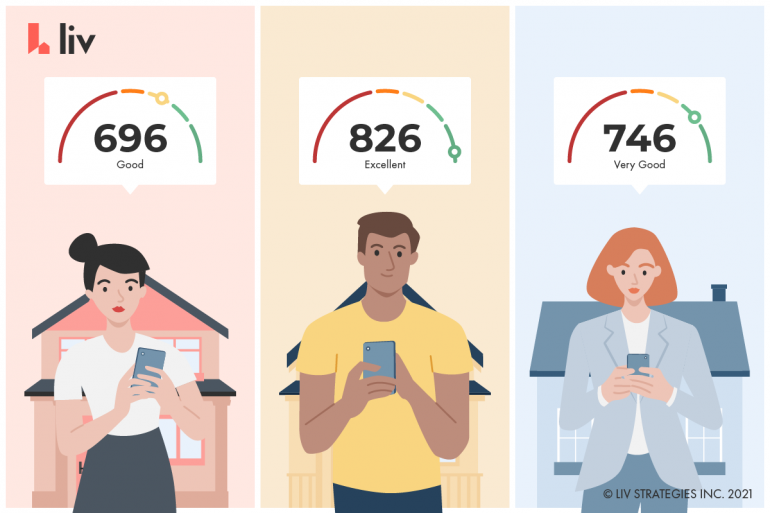

Its essential to keep your score on the high end of the scale but where do you start. In Canada you will get credit scores as high as 900 points as a simple starting point. So what does your credit score start at once you qualify for one.

If you live in Quebec you can. Their job is to. As soon as you swipe your credit card for the first time your credit card provider utility companies and any other creditors will begin reporting your behaviour to the big credit.

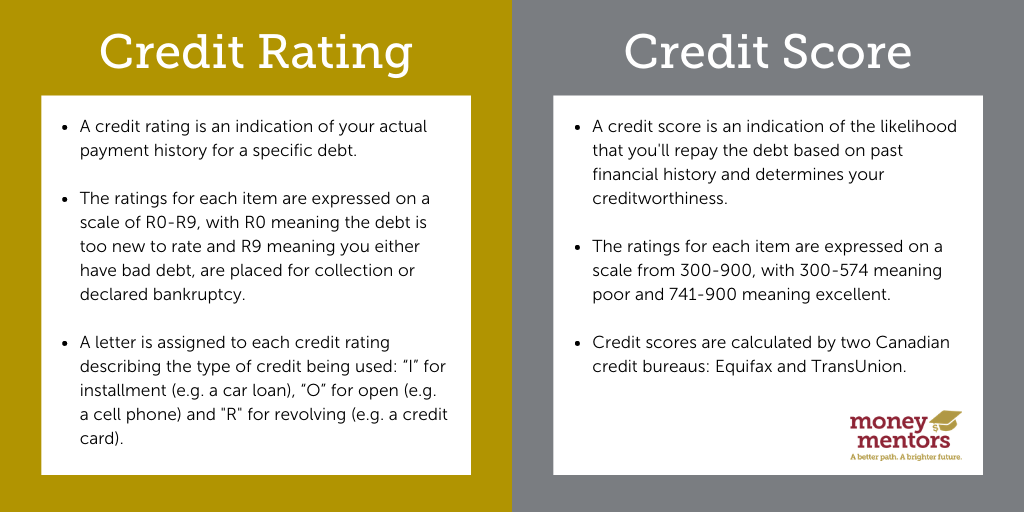

The FICO Score ranges from a minimum of 300 to a maximum or perfect score of 850. Who creates your credit report and credit score There are two main credit bureaus in. In Canada there are two main credit bureaus that can create a credit report in your name.

The first step in establishing and building credit is understanding what comprises your credit score. As a rule of thumb you want to check on your credit report at least once a year to see what your score is and also to correct any errors you might notice. According to TransUnion 650 is the magic middle number a score above 650 will.

Where does my score come from. Its essential to keep your score on the high end of the scale but where do you start. Credit usage or utilization ratio Credit history.

Your credit score is a three-digit number that measures how well you handle borrowing money. Though each credit bureau has a unique way of calculating your score. At the age of 18 you start your credit score with 300 when you get a job a loan or a credit card.

Plus payment activity is reported to the 3 credit bureaus Equifax Experian and TransUnion to build your credit. While closing an account may seem like a good. Most peoples credit score doesnt start at the.

Both Equifax and TransUnion provide credit scores for a fee. You have to actually have a line of credit in your name to start generating a score. If youre not sure what your credit score is its easy to find.

Multiple hard inquiries within a short time indicate greater risk and can hurt your credit score. In Canada credit scores range from 300 just getting started up to 900 points which is the best score. Helping business owners for over 15 years.

In TransUnions view a score that is above 650. Your starting credit score will fall below the median number of 723 even if you pay all of your obligations on time and according to terms during the six. Equifax and TransUnion are the two main credit bureaus in Canada.

So how can you check your credit scores. It will slowly improve based on your financial performance. ViDI Studio Shutterstock Most Canadians begin their credit history with their very first credit card which they can get on their own by the.

However the starting credit score isnt zero. Your credit score from Equifax is accessible online for free and is updated monthly. You can access your credit score online from Canadas 2 main credit bureaus.

Here are a few ways. Since credit scores range from 300 850 300 could be considered the starting score. How to Check Your Credit Score.

Purchase credit scores from a Canadian credit bureau.

How To Build A Good Credit Score In Canada Arrive

How Long Does It Take To Improve Credit Score In Canada Lionsgate Financial Group

What Is The Average Credit Score In Canada And How Do You Compare

Credit And Tax Secrets Canada How To Build Your Credit And Improve Your Credit Score Fast Save Money On Your Corporate Gst Hst Payroll And Personal Tax Mahoni Bashir 9781999273118 Amazon Com Books

Reputable Credit Repair Services Boost Your Credit Score Fast In 2022 Hindustan Times

What Does My Credit Score Mean Refresh Financial

Fico Credit Score In Canada What Is It And Why Does It Matter

Business Credit Report Run A Free Company Search Experian

The Ultimate Guide To Credit Scores In Canada

New To Canada Here S How To Build Your Credit Score Fast Creditcardgenius

What Credit Score Do You Start With In Canada

Credit History How To Fix Your Credit Score In Canada Youtube

7 Things That Are Not On Your Credit Report

Understanding Your Credit Score And Why It Matters Envision Financial

Your Credit Score Matters When You Rent An Apartment Here S What You Need To Know By Paula B Azevedo Medium

7 Myths About Credit Ratings Credit Scores In Canada Money Mentors

How Is Your Credit Score Calculated

5 Major Factors That Impact Your Credit Score In Canada

Eight Surprising Ways To Raise Your Credit Score Csmonitor Com